Study the Answer to How Much Does College Cost

For decades, college has been the expected “thing to do” after graduating high school. People believe it’s the best move to make in order to get a good job and succeed in life.

However, the amount of college debt that continues to grow gives many great pause when deciding if it’s the route to take. Many college goers work hard through college to graduate with a degree and tens or hundreds of thousands in college debt.

The questions on many people’s minds now are: How much does college really cost? Are there any ways to save on college costs? And is it still the best move to make? We’ll answer these questions below.

According to educationdata.org, the average cost of college in America is approximately $35,551 per student per year. However, the answer to this question varies widely, according to many factors including the degree program you choose. We’ll take a deeper look into various college costs below.

Tuition

Tuition is the largest cost factor in college, of course. It’s also the largest variable because so many things can impact it, including – but certainly not limited to – the following:

- Private colleges cost more than public colleges

- Certain states have higher overall tuition. (For example, tuition costs an average of about $5,360 in Nevada while Vermont charges an average of $13,448.)

- Out-of-state tuition is much higher than in-state (The average out-of-state in Nevada is $18,504 and in Vermont it's 37,640)

- Specific colleges, like Harvard and Yale, have higher tuition than most other colleges

These figures do not take into account any student loan interest, either.

Room And Board

Room and board is typically not included in the tuition figures – these are separate costs entirely. “Room” is the money that covers your living expenses while “board” is your food budget. Room and board typically falls around $10,000 per year or more.

If you’re going to an in-state university that you can just drive to, you can skip these costs, of course. For some out-of-state students, you can choose to live off-campus, which may save you some cash. However, most universities require students to stay on-campus the first year or two of their degree program.

Books And Supplies

Scholarships.com reports that the average national cost of books and supplies is around $1,100 for two semesters. I remember being in shock looking at textbooks that were nearly $200 each – and that was several years ago. Now, they can be as high as $400.

That is an insane amount of money, in my opinion, and it’s per book. Multiply that by the number of classes you take and it can become astronomical quickly.

Then, add that to the price of other supplies you need, including computers, paper, pens, notebooks, and everything else required to succeed. It’s easy to see how quickly the cost of college can grow. Fortunately, there are ways to cut these costs, which we’ll get into in a moment.

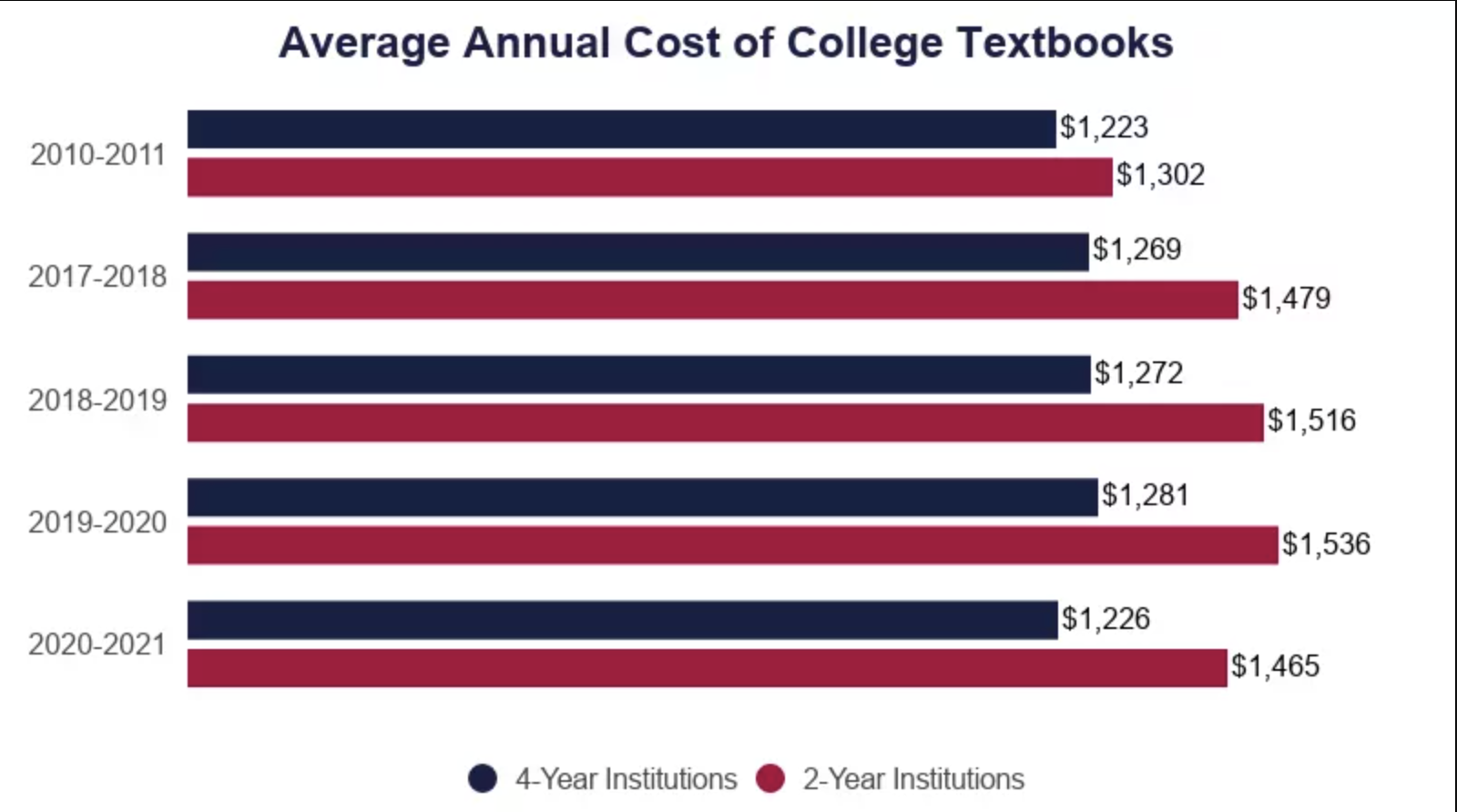

Average annual cost of college textbooks. Source: https://educationdata.org

Transportation

Transportation is another area that can vary greatly. If you have a car and are allowed to have it on campus, your transportation costs will be lower than someone who doesn’t have a car.

And, if you’re really fortunate, your college might be located centrally to everything you need, meaning you can walk to most destinations. However, this is the ideal.

In reality, most college students spend up to $1,800 on transportation. That’s not including costs to travel back home. It’s also not taking into account any studying abroad, if that is part of your program.

Other Expenses

Other expenses depend on you specifically, but most students spend about $2,000 per year. This category includes any extra stuff you choose and activities you want to be involved in.

Think things like cosmetics, clothing, toiletries, club fees, and similar items – and don’t forget to factor in the Ramen and other unhealthy food choices you want in your dorm. If you have medications and health insurance, you can budget those in here.

Explore Possibilities To Save Your Money. Meet Billry.

How Can I Save on College Costs?

If you want to go to college, you’ll want to find ways to save. Fortunately, we have a few ideas for you.

Get Help Paying

Let’s start with the obvious: financial aid. Do not forget to apply for financial aid every year. The more grants you can get to pay for school, the less you will be paying out-of-pocket.

Don’t overlook scholarships. There are plenty of these available out there for different degree programs, different interests, different schools, various GPAs, and more.

For instance, I was looking for ways to help my oldest son get scholarships that weren’t academic or sports-related. I ran across writing contests, science project contests, and more. Granted, the ones I found were smaller dollar amounts, usually about $500 to $1,000.

However, if you look at the expenses listed above again, you’ll see that just one of these scholarships can make a difference. If you can work towards a few of them, they can add up to a lot of help. Search online or ask your school for help finding some scholarship opportunities.

Start at Community College

Most people can attend their local community college basically for free with financial aid. Consider attending yours for your Associate degree, and then transfer to the larger institution of your choice.

Doing this can save you a lot of money those first two years, but there is an important fact to consider. Not all community college credits transfer well to other universities. You’ll need to do some research to make sure you’ll be able to take most of your credits with you.

Textbooks

Textbooks is one area that you can save a great deal of cash. The biggest secret here is to not buy a brand-new textbook when possible. Your college bookstore will likely have used copies of their textbooks at a deeply discounted price.

However, when I was in college, they always gave those paying cash first choice of textbooks so that they could get the discounted ones. This is fair, of course, but it might mean you can’t buy used from your bookstore.

If this is the case, there are still other options. Take a look on websites like thriftbooks.com, knetbooks.com, Amazon, and textbooks.com. You can often find very low cost textbooks, either in-print or digital.

Additionally, many of them offer a rental option. I remember paying like $15 to rent a text from one of these sites for a book that was going to cost nearly $300 brand-new.

Supplies

If you get strategic, you can save hundreds on regular supplies, like binders, paper, writing utensils, and similar items. Every year when school is back in session, retailers around the country stock up on school supplies.

Often, they do not sell them all. When this happens, they discount them. I am able to buy all four of my kids school supplies for the school year for about $20 each by waiting until these sales go on. And usually, I buy extra and put them away for the next year, too.

Also, Staples has good sales every year for school supplies. Again, all of this is for traditional school supplies. If you need specific items, you might have to look a little hard. However, you can save a ton of money buy getting regular supplies through these sales.

Loans

Student loans can be very helpful for getting you through school. Sometimes, though, their interest rates and terms are not favorable. There are times when a personal loan from a financial institution can save you some money. Before you sign on for anything, be sure you take a look at other options and compare.

Is College Worth the Cost?

It’s true – college costs a lot of money. And that costs seems a lot lower in the beginning than it does by the time you complete your program.

For a real-life reference, I began my college journey with an Associate degree that was approximately $30,000 for both years. By the time I completed my Master’s program, I owed a total of $140,000 – and that’s after all the financial aid was applied. To put that into perspective, I’ve seen some pretty nice homes for that amount.

So, the question is whether it’s worth it. The answer, I’m afraid, isn’t quite as simple as the question may seem. It really depends on you.

Personally, I would have likely gone another route with my education journey for a few reasons. One is that the career I have chosen actually does not use my degree program at all.

In ways, I feel as though I’m in debt for nothing. I have taken certification courses after my degree that charged much less and got me much farther.

However, my feelings don’t have to be your feelings. College can certainly be worth the cost if the career you want requires you to have a degree. It can also be worth it if the school you attend helps you through career guidance and placement.

My best advice to you is to stop and truly consider what you want to do with your life. Don’t think you have to go to college because that’s what everyone says you should do. And don’t go just to please someone – you will be the one paying for it.

Instead, think about what you want. If college and a degree are what you really want, you should go for it. The cost is worth it if it will get you where you want to go.

Conclusion

College is a choice – one you should thoroughly consider. If you decide it’s the route for you, it’s time to start budgeting and planning for it, and we have a tool to help you out.

At Goalry, you can make financial plans for school, budget for the costs, determine what steps you need to take, and even look for personal loans. Take a look for yourself. It can help you reach your financial goals, no matter what they may be.