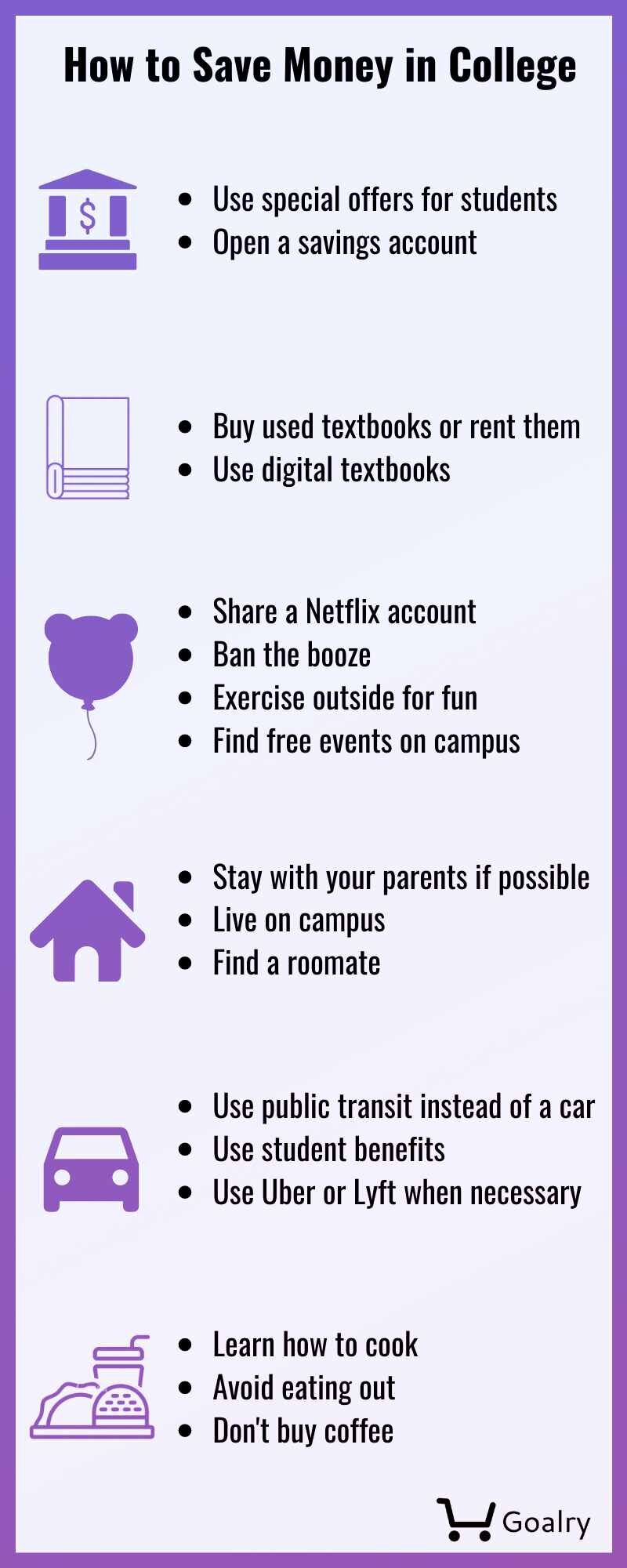

Your Study Guide to Save Money in College

Let’s face it: College is expensive. If it was not, the country would not have as much student debt as it does. Just because it is expensive does not mean you can’t save money, though. Here are a few effective methods to do so:

Your Overall Education

The first thing you need to do is decide if this is a degree you actually want. In fact, do you even want to attend four years of college? Sometimes a certification is just as good as a degree - and a lot cheaper.

I happen to know this from personal experience, so please feel free to learn from my mistake. I chose to attend college for a business degree. In a little under four years, I had a Bachelor’s Degree. I was so happy thinking about all the ways life was about to improve.

However, when I started applying for jobs, I was told I only qualified for a secretarial position. There is absolutely nothing wrong with being a secretary, but I did not need to attend four years of school for that - especially if I was barely going to be making more than minimum wage.

Someone suggested I go back and get a specialized Master’s Degree in business, so I did. Still, I had to continue working as a waitress. I was ready to scream. More than $100,000 of student loans and five years of school to work the same type of job I had been working since I was a teenager? It just did not seem right.

One day, though, I was looking at some stuff online and ran across a certification course for digital marketing. The entire course would take three months and cost me only $50 per month. I was a bit skeptical, but I was also desperate, so I jumped in.

It ended up being the best decision I made. Three months and $150 got me more work and opportunities than a five year degree and mountain of debt.

Now, full disclosure: I do not live in a large city with opportunities all around. I live in a pretty low key town in the South, so my situation may not be the same as yours at all.

It never hurts to do some research though. If it turns out that a certificate is the better route, you can do it for much cheaper and more quickly, meaning you can start making money more quickly.

If the degree route is better according to your research, no big deal. At least you know for sure then. It is just always better to take a good look at your different options and what benefits each can bring to you. Doing so can be one of the best steps you can take to save money in college.

Banking

There are many banks that offer special products and low fees if you open a checking or savings account through them. Ask around about the best one or check them out online and take advantage.

After you read the other tips below on how to start saving money in college, you can put your savings into this account. Trust me, you will need it one day.

Textbooks

You may think that you should keep your textbooks for future reference, but almost every graduate ends up throwing their textbooks away at some point. If they leave them packed up in a box, their kids or grandkids end up throwing them away.

The bottom line is that they end up in the trash eventually - and almost none of them have been opened again after college graduation. At the same time, they are necessary for your current situation, so you have to get them, but there are a few ways you can save money in college when buying textbooks.

Buy Used Textbooks or Rent Them

If you want to know how to save money fast and in large amounts, buy used textbooks. Your college bookstore often carries used books, but there are two other ways I have saved a ton of money on textbooks: Textbook Rush and Knetbooks.

These two very wonderful websites saved me over $1,000 during my school career. They have used textbooks that you can purchase for a fraction of the retail price. You also have the option to rent the textbooks. You simply pay a set price up front for a specific period of time.

When your rental time is up, you pack the textbook up in the prepaid shipping box to send back or extend your rental if you need to for some reason. It is quick, affordable, and really convenient, but there is something I love about them much more: They buy used textbooks.

This means that if you own any, you can make some cash back on them or get store credit- both of which are very nice. Before I discovered these websites, I was paying full price for my textbooks. I ended up selling all of those textbooks between the two websites and made more than $300- and the whole process from me shipping to them paying was around a week or a few days more. It was a pretty fast process.

You might also take a look at ThriftBooks.com. They, too, carry used textbooks. I have never personally bought textbooks from them, but I have bought other types from there. One thing I love about them is that you earn points every time you make a purchase. When you reach a certain point, you can cash those points out for a free book. Free is always good.

Choose Digital Textbooks

You should also consider digital textbooks when you can find them. Some of the textbooks I got from Textbook Rush and Knetbooks were digital rentals. These are usually even cheaper than the textbook rentals. It obviously depends on the book you need, but I remember paying less than $10 for a three month digital rental. A few rentals did cost a little more, but they definitely cost less than the retail price.

Entertainment

While you do definitely need to study and focus on school, you have to have some down time or you will quickly burn out. You do not, however, have to spend a bunch of money on entertainment. You can actually have quite a bit of fun for free or very cheap.

1. Share a Netflix Account

If your parents have a Netflix account, see if they will share their account with you. If not, see if your roommate will split the already low cost with you. If not, it’s pretty cheap anyway and definitely cheaper than hitting the movies all the time or paying for cable.

2. Exercise

Forego a paid gym membership and save money in college by using the campus facilities. Some have a pool that you can use when swim teams are not using them. Many have gyms you can utilize. And, if all else fails, you can run or speed walk around the physical campus. If you ask around, there may even be some groups you can join for running other exercises.

3. Ban the Booze

Something about college makes everyone to go a little crazy and drink. It is definitely not an uncommon thing. However, the goal here is to save money in college- not drink it all away. Try to avoid it or, at the very least, keep it to a minimum.

4. Events

If you take a good look around, you can probably skip paying for entertainment. Check for flyers announcing free movie nights, group activities, and more. There is always something happening on campus. You just need to find the information.

Housing Expenses

Truthfully, the best way to save money on housing is to live with your parents if they live close to campus.

The next best way is by living on campus.

If you cannot or do not want to do either of those options, find a house or apartment with some roommates.

Automobile

You can really save money in college by not having a car there. When you do, you have to pay for parking, sometimes higher insurance, gas that you might not otherwise need, and potential damage to your car.

Instead, use public transit. Some colleges give students passes or provide a discount, both of which are cheaper than the costs of having a car there. If you have a buddy on campus with a car, you might be able to borrow it as long as you pay for the gas. And don’t forget services like Lyft and Uber when you just cannot walk to where you are heading.

Classes

Every single class you take costs money - every one. This fact is always important but possibly more so for those paying cash for school or with student loans. Even those getting Pell Grants might end up having to pay for one or some of their classes if they go over the amount of funding they are approved for.

School is expensive enough without you adding to it, so follow these steps to save money in college costs:

Know Your Degree

First and foremost, you need to know what classes are actually required to complete your degree. If you sign up for one that does not get you credit on your degree program, you will end up having to take an extra class. This is a waste of time and money, so double check your degree program and make sure you are only enrolling in classes you need.

Pass Those Classes

Every time you have to retake a class, you also have to repay for that class. Don’t do that to yourself if you can help it. Be sure that you spend time studying and completing any assignments. There is nothing wrong with enjoying yourself, but do not do it at the cost of having to retake a class.

If you are struggling in any way, ask for help. There are typically many resources available to help students study. You just need to reach out for them.

Compare Classes

Be sure you take a look at the cost of each class you sign up for. Sometimes, the prices of each class differ according to what time of day it is held, how many credits the class is worth, and more. Take a look at your required courses to make sure you are enrolled for the lower cost one. As far as electives go, you might see larger variances. Take a look at the potential electives for your degree and choose the lower cost options.

If your college offers online courses, you might save money in college by taking those instead of attending the on campus. When you choose your classes, compare prices just as you should if you are purchasing a phone.

Start at Community College

If you can get a full ride scholarship straight out of high school to the university of your dreams, don’t let me stop you. If not, you might want to consider attending community college for the first couple of years. This can help you save money in college- a lot of money.

Just be sure that your credits will transfer. This step will do you no good if you end up having to retake classes because no one takes your credits. Do your research first.

Clothing

More than likely, at some point in time while you are at college you will need to purchase some clothes. Unfortunately, some college towns have much higher prices than others. Before purchasing at the local shops, compare those prices with online prices. You might find that the clothing and cost of shipping is lower than what you would pay at a local store.

Do take a look at thrift stores though. You can often find nice, brand name clothes for a fraction of the price you would pay elsewhere. It is always worth a look before spending a fortune.

Toiletries And Nonperishables

Buying in bulk is usually the best way to save money in college on toiletries and nonperishables. This is especially true if your parents or another family member have a membership for somewhere like Sam’s Club. When you go home for a visit, have them take you to the store and buy what you need then.

Even if no one has a membership, they are not that expensive and usually worth the price. You might also choose to buy online through Amazon or Walmart. Both have bulk items selections for excellent prices.

If you shop through Walmart’s online store or app, be sure you check the “Clearance” tab. I am always finding toiletries for really low prices there. The only downside to Walmart is that you have to pay for shipping unless you order at least $35 worth of merchandise.

This is not so bad if you need to buy multiple items at once, but not so good when you only need a couple of things. If there is a Walmart close to your campus, though, you can have it shipped to that store and pick it up for free.

Amazon often runs a special for students to get Amazon Prime for either free or really low cost. This is great for many reasons, one being because if you order your bulk items through Amazon, you can get the shipping free as long as it states that it is a Prime item.

Food

A lot of college kids spend a lot of money eating out. If you really want to save money in college, food is a good category to hit. And the best thing you can do for your wallet and your health is to learn how to cook to save money. No one is saying you have to be a master chef - just learn how to cook a handful of meals.

If you don’t have anything to cook with or not a lot of space, it’s okay. Just buy a hot plate, a Crockpot, a skillet, and a regular pot - with some cooking utensils, of course. You can cook a lot of meals with just those items.

While you are at it, buy yourself a little coffee maker. Buying coffee every morning is not going to help you save money in college.

Phone

If you are currently paying a ridiculous phone bill, swap over to an unlimited plan. StraightTalk, MetroPCS, and even Walmart have some great unlimited plans. You can talk and text to your heart’s desire without killing your wallet.

Other Tips

Here are a few other tips to help you save money in college:

-

Your campus library should have free Internet. If not, the town’s library or McDonalds probably do. You should not have to pay for it.

-

Don’t just get to know your campus- get to know the whole local scene. You never know what free and cheap things you might find or what you realize is closer than you think.

-

Some schools have perks for their students that get them cheap or discounted products. For instance, my college provided free Microsoft Office software while I attended school as well as a big discount on other Microsoft products. My husband’s art college provided free Adobe software and a discount on Apple products.

Different schools have different perks that can help you save money in college, but they do not always announce them straight to you. Browse the college website, ask other students, check out discussion forums and bulletin board. Also, check any admissions guides or manuals you received.

-

Any time you need to buy something, ask if they offer student discounts or look around on the company website. You can even Google the term “college student discounts” and find various ones reported by other students.

-

You do not have to stop applying for grants and scholarships just because you have already been accepted. You can continue every year. I was awarded a partial scholarship from my school for grades but that did not happen until my second year of consistent good grades. Still, it helped me save money in college, even if I only got it for about half the time I was there.

Talk to the financial aid department to find out about any potential scholarships or grants you can keep applying for. They should be able to tell you if there are any offered by the school for sure but also at least some external ones.

Conclusion

As you can see, there is no shortage of ways to save money in college. The most important thing is really to pay attention to the financial choices you make and ask for information on anything you think might help. Also, pay attention to what is going on around you. You never know what money -saving option is right under your nose - like an event that serves free hotdogs.