Saving

Even the question itself practically drips with the desperation many of us feel whenever the subject of how to save money is approached. Some of us just assume it’s a topic for other people, or for another time. We probably even have some ideas about what’s involved in establishing meaningful savings, some ideas on how to cut bills, some ways we could bring in a little extra cash, but…

The excuses begin running through our minds before we’re even aware of our own defensiveness. “How do I save? I CAN’T. NOT NOW. I WISH. MAYBE OTHERS, BUT FOR ME… IMPOSSIBLE.”

Maybe you expected an argument, given that at Billry, and across the Goalry family, we’re all about the power of savings, the cumulative impact of following a few practical saving tips, and tools and resources to support your efforts. But you’re right. We could devote another ten thousand words to various methods of saving money and it wouldn’t matter – not if you truly believe that for you, all the good ways to save money are nice for others, but impossible for you.

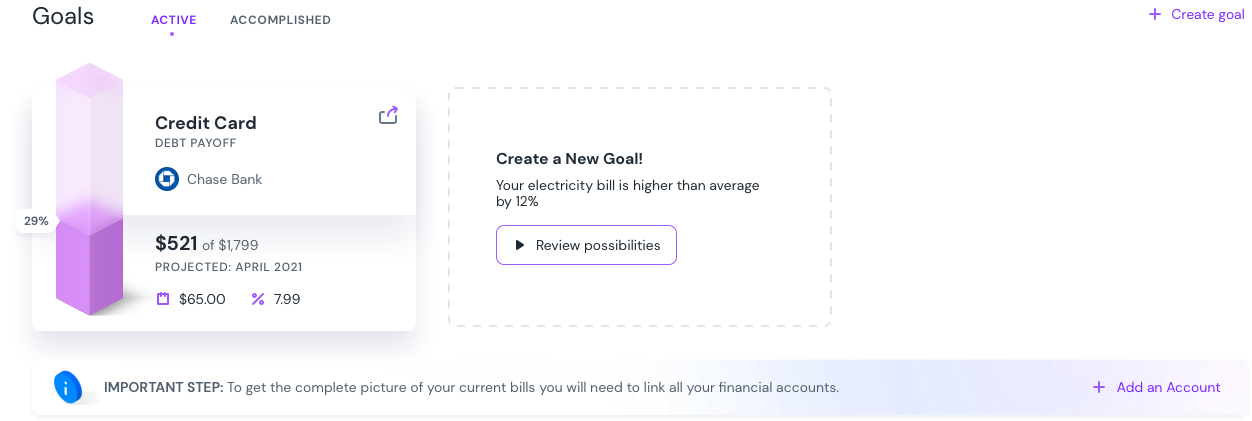

It’s your money, and you’re always in charge of what you choose to do with it. Wouldn’t it be nice, however, to be asked from time to time if you’d like to do this smart thing you keep meaning to do, or avoid this careless thing you’ve repeatedly sworn to change?

Get instant access to thousands of encouraging articles and personal financial insights, or any of the hundreds of informational videos in our library

Get online tools that don’t just help with the math, but the motivation as well

Get help figuring out how to lower monthly bills, feed a large family on a tight budget, or other money-saving ideas popping up

Imagine an approach to savings with Billry that can be as personal or as detached as you wish it to be. We’ve been there; just say the word and we’ll be there with you again.

If you're a big coffee lover like me, that can have an impact on your finances. So how do you save money on coffee while preserving the taste and quality? Here’s my quick, tried, and true guide!

Whether to go to college or a vocational training center, many leave the family home and begin to bear all or part of their own expenses. Therefore, it is important to know where to find student discounts. We have some useful tips for getting student discounts, you just need to keep reading.

You can improve your financial situation by following some helpful tips on how to spend less money. While it can be challenging to cut your spending, you might find it easier than you thought if you put some research into it. Here are 20 simple tips that you can use to reduce your spending.

In this article, we'll answer the question “how much does it cost to move?” for you and discuss how working with Goalry can help you save money or fund your new moving experience.

Are you interested in installing a real home theater in your home? Maybe you dream of watching your favorite movies on a large screen with surround sound. Keep reading this article in which we break down the cost of installing a home theater.

A home gym can save trips to the gym or checkout at rush hour, allows you to train at the time that is most convenient for you and you can use any material you need without ever expecting them to be available. If this was what you were looking for to gain more motivation, then this article is perfect for you to help you outline some of the most important steps to keep in mind when planning to build a home gym.

Have you ever thought of learning from home instead of going to a learning institution? This is not something new in America because many people have been doing it for years. However, before you decide whether to enrol in an institution or learn from home, it is important to understand the benefits of each option.

Eating out every day for lunch gets expensive quickly. In addition to it being a hit to your budget, eating out may not always be the healthiest way to eat. These helpful and tasty tips contained in the article will help you save money on lunch and eat well.

Are you getting married soon? Congratulations on such an important step! The problem is, this happy event can be particularly costly. However, do not panic! We have some great ideas for saving money, you just have to keep reading.

Imagine a savings account you could utilize with a click or a swipe whenever it’s most convenient or most appropriate for you. Imagine competitive rates or flexible terms designed to help you

Sure, your odds aren’t great, if by “save more money” you mean resolving all of your financial challenges and eliminating your entire debt before the next full moon, and without meaningful changes in how you think about your income and your spending habits.

Admittedly, it’s not looking too good, if when you think about how to save money on bills, you expect every change to produce hundreds of extra dollars in your pocket and swell your savings more or less automatically.

Perhaps “impossible” is the right word, if every journey into how to cut expenses or how to save on a tight budget is cut short by doubt and indecision. Let’s be honest – it’s difficult to focus on how to lower your monthly bills or why you should celebrate small victories if you’re distracted by little things like being mired in hopelessness or derailed by despair.

You can start saving right now, today. You don’t even need to memorize a hundred different money saving techniques or sell one of your children or pawn off essential organs. There are smart ways to save money and lower your bills and all those other things that we already kinda know we should be doing – not because life is all about money, but because they lead to greater financial security, help us build up some savings, and give us more time and resources to do the things which ARE important to us, with the people who make it all matter.

The big decisions matter. Financing a vehicle. Taking out a credit card, Taking out a mortgage on a new home. Vacations. Weddings. Medical or legal debt. Student loans. Changing jobs. Moving to another state. That’s why we have resources, information, and online tools devoted to each and everyone one of these, and more.

But there’s an even more powerful truth many of us overlook when it comes to money saving tips or how to lower bills and cut other expenses. It’s rather earth-shaking, so you should probably sit down before we continue.

Here’s the thing – most of us have a general idea of potential ways to cut bills or how to save money each month. There’s more we could learn, sure, but it’s not like we don’t already understand that making store-bought coffee in our reliable old $20 coffee pot is way cheaper than stopping at the local Organic Brew and Stew every morning, or that we should really try to figure out why the cable bill went up a few months ago even though you we don’t remember changing anything.

We assume our realtor would tell us if there were better places to get a mortgage or handle all of that paperwork, so we don’t investigate alternatives. We figure the dealer must naturally have the best financing options, so we don’t apply anywhere else. We know we have weak credit, so we’re thankful for the first offer that comes along and we don’t ask too many questions. One of the best ways to save more money is to educate ourselves on the options and get a better understanding of how some of these things work. That’s a primary goal of Billry and the entire Goalry family.

You may understand that having that last slice of pizza is going to make it harder to lose that weight that’s been bothering you, but at that exact moment you don’t feel like it matters that much in the long run. You know walking is better than sitting, but when it’s time to walk, you suddenly can’t imagine it will help all that much this one time. It’s the same way with saving money. Even when we KNOW, we need to be reminded that each good decision and each small savings matters – as long as we keep doing them.

Life is complicated and busy and sometimes we simply have to pick which things get our focus and energy and which just… don’t. That’s a large part of what drives the fitness tracker craze. Most people with those little devices on their wrists or apps on their phones already know they should move around more and take in fewer calories and such. What the technology does is offer friendly prompts and reminders throughout the day. Some even make it easier to access information or connect to essential services or supplies. In other words, the right online service or supportive phone app can help you change habits you’ve already decided you want to change. It’s like having a personal financial trainer offering advice, insight, and motivation throughout the day at the moments you need it most. It’s there to work for you and help you move towards your goals; you’re not there to satisfy it.

One place to reach financial goals and comparison shop for any money matter.

Most of us don't know where to start when it comes to improving our financial health. For some, handling their finances is akin to driving with a blindfold on. This is often why many people don't know how to stop living paycheck to paycheck.