Business Bill Management

Why did you decide to go in business for yourself? Wait, I think I know – it’s because you loved the idea of sitting at a desk with an oversized hardcover check book, a jumbled stack of invoices, purchase orders, and utility bills, and a spreadsheet that made more sense when your brother-in-law set it up than it has since! Come on, who doesn’t love spending one day a week wrestling with work expenses and trying to keep up with accounts receivable?

Other than everyone, I mean?

They say “time is money,” and that’s never more true than when you’re trying to run your own small business with high hopes but low overhead. Sure, you could hire someone whose primary job would be to manage invoices and keep up with office expenses, but you’re nervous about handing over your business’s detailed financial records and responsibility for keeping the lights on to the new girl. Besides, if you could afford to hire someone else, there are other things you’d rather new employees be doing. You’re pretty sure there are places that do invoice management and bill payment services for businesses, but worry they’ll cost too much and that you’ll lose that day-to-day control of your business’s finances. As much as you’d like someone else to do it, you didn’t make it this far by handing off every difficult task to someone else. You found a way.

The good news is that business bill management doesn’t have to consume all of your time. Juggling accounts receivable, invoices, and expenses will always be part of owning your own business, but they don’t have to own you or your business. The solution is brewing right here, with Billry.

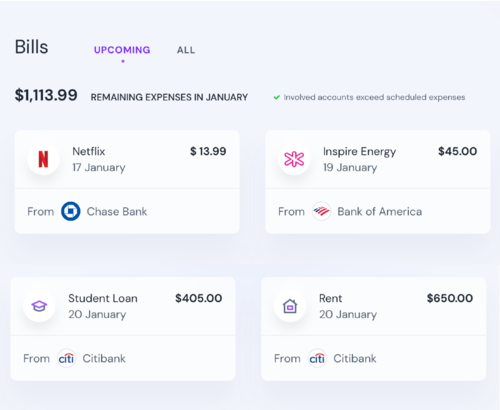

Imagine doing more receiving while spending less time accounting thanks to easy online billing alerts for small business from any connected device. Set up automatic reminders and run small business billing reports with a click or a swipe. You’re still making the decisions; let the technology do most of the work.

We have this crazy idea at Billry, and across the Goalry family, that while taking more effective control of your personal and small business finances may not always be easy, it doesn’t have to be as complicated as our current way of looking at things often makes it seem. We believe that with the right information, tools, and connections, most of us are perfectly capable of making better decisions and strengthening our financial skill sets.

It’s not about the money; it’s about what the money allows us to do, and who we’re able to take care of with it. It’s about the places we can go, the businesses we can start, the problems we can solve, and the experiences we can share.

And maybe some of it IS about the money. We’re OK with that, too.

Imagine saving money by knowing exactly when everything is due and making more money because it’s easier to keep track of what you’re owed. Imagine having your small business finances and billing at your fingertips or a few clicks away on any connected device.

Now imagine that this same business bill management app can be interconnected with as many or as few related financial management tools as you choose, all with one easy membership key. It’s about more than online business bill management. More than an improved analysis of employee business expenses. More than online billing for small business or a clever way to manage invoices.

It’s unified finance. It’s spending more time on your business and less time on bill management.

If you’re running your own business, time is often your most important investment and most essential commodity. Chances are you don’t need the most complex spreadsheet Economics majors can devise or the fanciest software or phone apps to brag about at your next conference. The best app to support business bill management is the one that allows the most power and flexibility while being the easiest to use. It should let you get back to business, not take away even more time from your business figuring out how it works.

Maybe you like wading through all those invoices, purchase orders, utility bills, and check stubs. That’s your call. Your competitors, however, are spending that time exploring new markets, testing new products or services, and helping their employees become more effective members of the team.

The ability to more easily analyze your expenses or your accounts receivable allows you to make better decisions and take more effective control of your small business finances. Take advantage of early payment discounts and avoid unnecessary fees from overlooked due dates or misfiled paperwork. If you’ve been in business for a while, you know how often it’s the little things that add up to big successes or unnecessary shortfalls. The same is true in reverse. Making your billing and account management more efficient is essentially “found money.”

The simplicity and power of online business bill management allows you to visualize trends in both receiving and spending in a variety of ways. Catch small problems before they become big problems, and build efficiencies where you hadn’t even realized the opportunity existed. It’s not about obsessing over money; it’s about responsible attention to the little things which so quickly become the big things. It’s about being intentional with your resources and making sure your spending reflects your priorities, whatever those may be. It’s about ensuring that you’ll be able to continue taking care of yourself and your loved ones. It’s about providing ongoing opportunities for growth and prosperity for your employees and suppliers.

Every small business in the U.S. is part of the bedrock of the American economy. Part of being a true entrepreneur is that you owe it to yourself and to everyone around you to make the best of what you’re continually creating. Every time you choose “small business billing” or click “manage invoices,” you’re also choosing “grow my business” and clicking “create employment opportunities.” Apps to organize your business expenses list or online bill payment services for businesses are just support services for what really matters – you and your small business.

If you’re running a small business, you obviously don’t mind a little stress and a LOT of effort. But hopefully it’s NECESSARY stress and effort – things only you can do, that move your business closer to its goals. Organizing invoices and keeping up with normal business expenses may be a necessary part of running things, but that doesn’t mean it has to be harder than necessary or take longer than required in the 21st century. Unless your goal was to spend more time sorting out paperwork, that time and energy could be better spent focused on the reasons you DID go into business.

Misplacing a purchase order or missing a payment or two may not be the end of the world, and it doesn’t make you a bad person or an irresponsible business owner. What it does do, however, is chip away at efficiency and your sense of having things under control. It impacts the long-term credit rating of your business and adds unnecessary complications and costs when it’s hard enough to make a living these days as it is.

Like the slow trickle of water that eventually carved out the Grand Canyon, a lack of business bill management makes everything else more stressful.

Everyone’s talking about the importance of “going green” these days. Maybe you support this entirely and want to do it solely because it’s the right thing to do. Maybe you’re willing to play along, but not entirely certain how much it’s accomplishing. Or maybe you think it’s all nonsense and people need to get back to what really matters.

Honestly, it almost doesn’t matter what you believe about “going green” these days. You’re unlikely to lose customers or sacrifice goodwill by being environmentally responsible, but quite likely to offend or lose business if you cross your arms and refuse. In other words, there’s much to gain and very little to lose by observing a few basics – recycle when possible, take it easy on the fossil fuels when you can, and – here’s the easy one – go paperless whenever practical.

It’s less clutter. Easier to keep track of and search digitally. It certainly takes up less room. And yes, it’s better for the environment.

Like your credit history, your customer service, your extra attention to details and quality, enough little things – good or bad – add up over time.

If all you’re looking for is the best app or website to streamline online billing for small business, helping you manage invoices and work expenses, or otherwise help your place of business (even if that’s working from home), we’re glad you’re here. We’ll soon be rolling out our own upgraded business bill management service helping you spend less time on the “have to” and more time accomplishing your vision. Like everything we do, our goal is to offer you enough power and flexibility to fit your specific circumstances while keeping things simple and intuitive to use.

If that’s enough, and the only reason you’ve come to this part of our Goalry Financial Mall, that’s awesome. Welcome. We’re glad you found your way to us, and we’d like to do whatever we can to help while you’re here.

As long as you’re here, however, please know that taking advantage of the tools and information offered here at Billry gives you the same access to our sister sites and anything they have to offer as well. If you’re considering an equipment loan or expanding your business, we have information and insights you might want to check out over at Loanry before making your final decision. If you’re worried about your retirement options for yourself and your employees in these complicated times, you’re not alone – it’s a regular topic over on Wealthry. Need some ideas on reducing your small business tax obligations or a better understanding of how to accurately assess the value of residential or commercial real estate? Try Taxry and Accury, respectively.

Managing debt, comparing loan options, figuring out whether to by a new or used car or truck – even strategies for improving your credit score. It’s all here, and growing exponentially as more and more Americans discover the simple power of unified finance.